The Ultimate Guide to Budgeting Weekly Paychecks

If you are having trouble managing your money, it may be because you don’t have a clear idea of how much is coming in and going out on a weekly basis. Budgeting can help alleviate some of the stress from not knowing where all your money goes each month. This article will teach you how to budget weekly paychecks so that you can finally get control over your finances!

A lot of people have asked the question “I get paid weekly but my bills are monthly, how can I budget?” The reason that this is a challenge is because if you are getting paid weekly you don’t necessarily have enough money in your weekly paycheck to pay bills like rent from one paycheck. It can be difficult to feel in control of your finances when you feel like the numbers don’t all line up.

But I want you to know it is possible to have control of your finances and tell your money where to go even when you get paid weekly. So let’s talk about it.

What does it mean to budget by paycheck?

Budgeting by paycheck means that you have either weekly or bi-weekly paychecks that differ in amount each time, usually because you are an hourly or part-time worker. Because the paycheck amounts are different each week, it can be difficult to determine how much you have available to spend each week, which makes it more difficult to create a consistent plan. This guide offers tips on how to budget your money each week.

Who is the paycheck budget method right for?

This is a method of budgeting that can work for anyone who wants to change their way of spending and save money. It works especially well for folks who are currently living paycheck to paycheck and struggle to budget their monthly fixed expenses.

1. Create a Monthly Budget Calendar

The first step for budgeting your weekly paycheck is to create a calendar that will be the map for your budget. This calendar can be on paper or even through an app or on a spreadsheet. Choose the method that you feel the most comfortable with as that will be what works best for you.

2. Know What Days You Get Paid

To begin the budget calendar, you will want to determine what days of the week you will be receiving the paychecks each week, and then input those dates into the calendar. Even though the amount each week may be uncertain this will allow you to see when the money will be coming in so that you can plan shopping trips and bills around these dates.

3. List Your Fixed Expenses

Next you will want to add the due dates for your fixed expenses into the calendar as well. Your fixed expenses will be the bills that occur at regular intervals such as rent, utilities, mortgage payments, and car payments. Because these expenses are fixed the amounts will stay the same each month as well as the date that they are paid.

4. List Your Variable Expenses

Lastly, you will want to create a list of all of your other variable expenses. Variable expenses include items such as groceries, gasoline, clothing, and other household supplies. After listing out these expenses, include estimates of how much you will spend in each category each week. You can do this by looking at how much you have spent in the past, but if you are unsure of the correct number, then I would recommend spending a week or two keeping track of your expenses so that you can get a better idea.

Don’t forget to include savings in this number! The recommended amount to save is 10% of each paycheck. This money will go towards unexpected expenses or your larger financial goals for the future.

5. Write Out Your Weekly Budget

The next step after creating your monthly budget calendar is to create a weekly calendar to budget your weekly paychecks. If you are a part-time worker and your paychecks differ each week, this step will be more difficult for you, but certainly not impossible! It will just take a little bit more work. And just imagine how great it will feel when you finally have control over your money!

The first thing you will want to do is look at the lowest amount that you can expect to be paid each week. So if you work between 15 – 20 hours a week, then you will want to budget for only 15 hours. Doing this will ensure that you never come up short in your budget and that you always have as much money as you need for the week. Any extra income or extra paychecks that you receive that exceeds the budgeted amount should be put towards either paying off debt, into a savings account, or an emergency fund.

After you have determined this amount you will want to create your weekly budget. The best way to do this is to enter the list of estimates that you made for your variable expenses and make sure that you are not spending more than you are making and that you are saving for future emergencies as well as your financial goals.

Everyone will have a different idea of how much they want to spend in each category, so the best way to decide is to think about which categories are important to you.

6. Add in Monthly Bills and Expenses

The third step is to see what weeks you will be paying your fixed expenses on a monthly basis and add those to the weekly budget. This number will change each week depending on which bill will need to be paid.

Additionally, if these bills are bunched up in one week rather than evenly spread out, you may need to save up in the previous weeks in order to pay them on time. This will have to be planned out on the monthly calendar so that you can see which paychecks will need to be used to pay each bill.

Tip: You can try to have different bills due on specific days so that the due date works best for your budget. To change the due date of your bills, you will need to contact each provider and ask them directly.

7. Include Infrequent and Emergency Expenses

Infrequent and emergency expenses such as car repairs or medical expenses, will come out of your savings whenever they come up. This is the reason that it is so important to have savings, because you never know what the future may bring. It is always best to be prepared for any emergency that might come your way.

8. Use Cash Envelopes for Your Weekly Spending

One problem that many people have when trying to budget weekly paychecks is that they spend more than they have budgeted each week. This is easy to do when you swipe your credit card or debit card that doesn’t have an accessible total that you can see to limit your spending.

By using the cash envelope method you can control your spending and will be forced to stick to the budget that you have set for yourself.

related: How to Start Using the Cash Envelope Method. It’s Easy!

9. Create a List of Financial Goals

The best way to stay motivated to continue budgeting is to create a list of savings goals that you hope to achieve. This list will look different for everyone but could include saving for a new car, house, laptop, or that vacation you’ve been wanting to go on for years now.

Regardless of what the goal is, by keeping your eyes on the prize, you will be more motivated to continue following the budget that you have created!

Pay down your debts as soon as possible

Another good financial goal is to pay off your debts as soon as possible. Doing this will give you more financial freedom to spend your money how you choose, and to save up for larger goals in the future.

Financial guru Dave Ramsey says, “Financial freedom means that you get to make life decisions without being overly stressed about the financial impact because you are prepared. You control your finances instead of being controlled by them.”

You want to focus on paying off your higher interest debt first so that you pay less in the long run. The best way to pay off debt quickly is to use the extra income that exceeds your budget, and throw that money at the debt in order to bring it down as fast as possible. Once you pay off that debt, then you will want to move on to the next highest interest rate.

Make it Your Own!

Lastly, it’s important to remember that this is your budget and it should fit the way you want to live. It should reflect your values and goals! It is okay to be flexible with your budget and change the numbers if you decide that it is not quite working for you. Having a rigid budget that makes you miserable will kill your motivation to save money and will hurt you more in the long run than it actually helps.

So be flexible, but remember to keep your eyes on the prize!

I hope you found this article helpful. What are your thoughts on budgeting? Have you tried any of these tips to budget your weekly paychecks? Share in the comments below and let me know what worked for you!

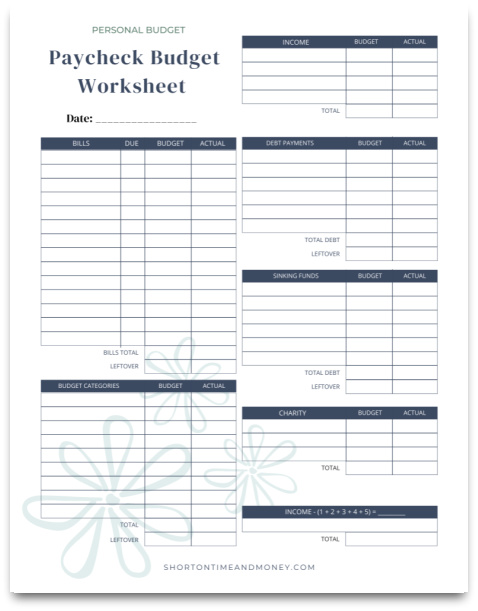

Free Printable Paycheck Budget Worksheet

How to Use

- Click here to get instant access to my free printable paycheck budget worksheet.

- Print the worksheet out and place it in your budget binder.

- Fill out the worksheet each time you get paid.